Latest

Bloomberg News Now

Listen to the latest news: Explosion in Iraq, Bitcoin Halved, More

5:06

Bloomberg Opinion

Bloomberg News Now

Listen to the latest news: Explosion in Iraq, Bitcoin Halved, More

5:06

Latest

An Irish Liquidator Plays Cat and Mouse With Russian Jets

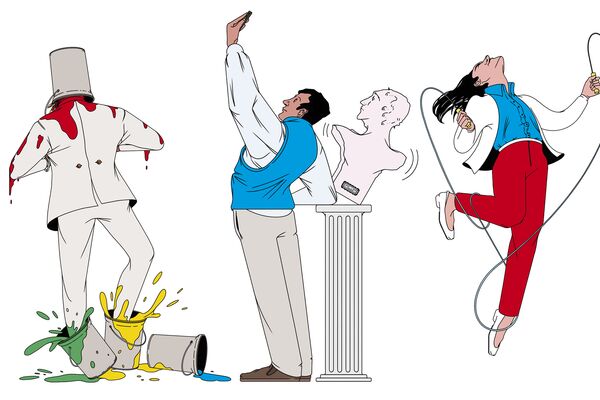

The AI Chatbot That Could Transform Business School Accreditation