Overview

Due to high demand online registration for this event has now been closed. Please reach out to info@fsb-tcfd.org in case of any questions.

You are invited to join the Task Force on Climate-related Financial Disclosures (TCFD) and the Bank of England (BoE) for a stimulating discussion on how scenario analysis can help companies and financial markets to assess climate risks, and how they can use scenarios for strategic planning and risk management processes.

During the two-day conference:

- Gain an overview of why scenario analysis is useful for assessing climate-related risks and opportunities and how it fits within the TCFD recommendations.

- Discuss how leading companies apply scenario analysis today and learn about available scenario analysis tools and data.

- Along with climate modelers and business leaders, identify further work and collaboration needed to better integrate climate-related scenario analysis into strategic and risk management analyses.

Day 1 will provide a high-level overview of the TCFD recommendations with regard to the use of scenario analysis; what scenario analysis is and why it is useful for assessing climate-related risks; how climate-related scenario analysis works in practice today – who is using it; experiences; and available tools. Day 1 is hosted by the FSB TCFD.

Day 2 aims to bring together business practitioners, leading researchers from academia, and finance professionals to discuss in more detail how climate-related scenarios can be used for strategic and financial risk analysis and how scenarios could be improved. The goal is to highlight successful approaches, and identify further work and collaboration needed in this area. This day will be conducted under Chatham House rules. Day 2 is hosted by the Bank of England.

Please find the agenda below, which will be updated as speakers are confirmed. A more detailed agenda in pdf format is also available for download at the bottom of the agenda under “download attachment”.

For more information on the Task Force, please visit www.fsb-tcfd.org and follow us on @FSB_TCFD.

TCFD Secretariat

Agenda

Day 1: Using scenario analysis for assessing and disclosing climate-related risks and opportunities (hosted by the FSB TCFD)

- 08.30 – 09.00

Registration and breakfast

- 09.00 – 09.05

Welcoming remarks

- Speaker: Mary Schapiro

- 09.05 – 09.25

Keynote address – Business and climate risk: using scenarios to deal with financial risk

- Speaker: Lord Nicholas Stern

- 09.25 – 09.45

Session 1 – Scenario analysis: what is it and how can it help business deal with climate risk?

Objective: This session will discuss how companies can analyse the resiliency of their corporate strategies under conditions of uncertainty using scenario analysis and the importance of thinking about a range of plausible futures and thinking outside the business-as-usual box.

- Speaker: Andrew Blau

- 09.45 – 10.30

Session 2 – IEA and IAMC scenarios: what are they and how are they used?

Objective: Scenario producers explain their work.

- Speakers: Seb Henbest, Dr. Elmar Kriegler, Dr. Christophe McGlade

- 10.30 – 10.45

Coffee break and networking

- 10.45 – 12.15

Session 3 – Current use of climate-related scenario analysis in various business sectors

Objective: Discuss examples of how scenarios are being used in practice. This session will present brief overviews of how various firms in a range of sectors use scenario analysis to assess and identify climate-related risks, conduct strategic planning, integrate climate risk into strategic and risk management frameworks, and communicate strategic resilience to stakeholders.

– Oil & gas sector

– Electric utility sector

- Speakers: Jeremy Bentham, Zita Marko Daatland, Claudio Dicembrino, Laurel Peacock, Javier Torres

Moderator: Curtis Ravenel - 12.15 – 13.30

Lunch

- 13.30 – 15.00

Session 3 continued

– Transportation

– Materials sector

- Speakers: Dr. David McCollum, Dr. Marcus Wachtmeister, Fiona Wild

Moderator: Curtis Ravenel - 15.00 – 15.15

Coffe break and networking

- 15.15 – 16.00

Session 3 continued

– Financial sector

- Speakers: Meryam Omi, Jillian Reid, Jakob Thomä

Moderator: Curtis Ravenel - 16.00 – 16.45

Session 4 – Overview of selected existing and emerging scenario tools

Objective: This session will briefly showcase some of the tools and data available for use by businesses in conducting climate-related scenario analysis.

- Speakers: Dr. Martin Juckes, Leonardo Martinez-Diaz, Dr. Keywan Riahi

Moderator: Charles Allison - 16.45 – 17.00

Wrap-up of day 1

- Speaker: Curtis Ravenel

- 17.00 – 18.30

Reception

Day 2: Climate scenarios for improved strategic and financial risk analysis – pushing the analytical frontier (hosted by the Bank of England)

- 08.30 – 09.00

Registration and breakfast

- 09.00 – 09.05

Welcoming remarks day 2

- Speaker: Carsten Jung

- 09.05 – 09.30

Keynote speech

- Speaker: David Rule

- 09.30 – 10.30

Session 1 – Setting the stage: the scenarios research landscape

Objective: Highlight the key areas of work by leading scenario producers.

- Speakers: Dr. Elmar Kriegler, Dr. Christophe McGlade, Dr. Sonia Yeh

Moderator: David Rule - 10.30 – 11.00

Coffee break and networking

- 11.00 – 12.15

Session 2 – Approaches for using scenarios in strategic decision making

Objective: Outline the various ways in which businesses can use scenarios.

- Speakers: Jeremy Bentham, Seb Henbest, Matthew Jurecky, Dr. Nicole Röttmer

Moderator: Dr. Misa Tanaka - 12.15 – 13.15

Lunch

- Speaker: Emilie Mazzacurati

- 13.15 – 14.30

Session 3 – Using scenarios to inform financial planning and asset pricing

Objective: Discuss the various ways in which financial institutions can use scenarios for investment decision making.

- Speakers: Nick Butler, Deepa Venkateswaran, Dr. Christopher Weber, Michele Della Vigna

Moderator: Dr. Silvia Pepino - 14.30 – 15.00

Coffee break and networking

- 15.00 – 16.15

Session 4 – Parallel breakout workshops: pushing the frontier

Workshop 1: Taking existing approaches further: scenario analysis in the oil, gas and power sectors

Objective: Many oil, gas and utilities are already using scenario analysis and have developed advanced technical capabilities. In this workshop they can exchange experiences and develop new ideas, together with academics and financial sector experts. Jointly with scenario producers, they can identify what methodological challenges and data issues are and how they can be overcome.

Workshop 2: Making scenarios work for other sectors (including transportation, heavy industry, land use)

Objective: The aim of this workshop is to push the frontier in sectors where climate-related scenario analysis has been less common. Participants will discuss with scenario experts what scenarios are most appropriate for the transport, heavy industry and land use sectors. Participants may want to discuss how this can be applied to the financial sector.

- Speakers: Jeremy Bentham, Zita Marko Daatland, Dr. David McCollum, Vincent Papa, Laurel Peacock

- 16.15 – 16.30

Session 5 – Wrap-up and next steps

Objective: The day’s chair will summarise key aspects of the day and suggest avenues for further work.

- Speaker: Carsten Jung

- 16.30

Close

Speakers

Lord Nicholas Stern

Lord Stern is IG Patel Professor of Economics and Government at the London School of Economics as well as Head of the India Observatory (LSE) and Chairman of the Grantham Research Institute on Climate Change and the Environment. He is President-elect for the Royal Economics Society and is a member of the G20 Eminent Persons Group. He was President of the British Academy (July 2013 – July 2017) and was elected Fellow of the Royal Society (2014). He has held previous posts at universities in the UK and abroad. He was Chief Economist at both the World Bank, 2000-2003, and the European Bank for Reconstruction and Development (1994-1999). Lord Stern was Head of the UK Government Economic Service (2003-2007) and produced the landmark Stern Review on the economics of climate change. He was knighted for services to economics in 2004, made a cross-bench life peer as Baron Stern of Brentford in 2007 and in June 2017, was appointed Companion of Honour for services to economics, international relations and tackling climate change. His most recent book is “Why are We Waiting? The Logic, Urgency and Promise of Tackling Climate Change”.

Charles Allison

Charles Allison is a partner at the global sustainability consultancy ERM, leading the company’s specialist advice on business responses to climate change. Charles and his team help organizations to assess climate-related business risks and opportunities, develop responses and implement management programs to protect and build business value. The result is efficient operations and compliance; enhanced and protected reputation; preparedness for low-carbon markets; and resilience to physical impacts.

Charles has supported organizations across all major industry sectors and all continents, from Global 500 multinationals to major private equity portfolios, in their response to the climate challenge. He draws on prior experience through the 1990s of working as a policy analyst, supporting government bodies across Europe to develop and implement environmental policy and regulation. Charles recently led the ERM team which helped the Taskforce on Climate-Related Financial Disclosures to develop its recommendations on use of scenario analysis to inform forward-looking assessments and disclosures.

Andrew Blau

Andrew Blau is a Managing Director and practice leader at Deloitte & Touche LLP. He was the chief architect and founding head of Deloitte’s Strategic Risk practice, created to help senior executives spot and prepare for disruptive threats to the way they do business through the use of scenarios and other futures thinking tools.

He joined Deloitte in 2013 as a partner in The Monitor Group, a global strategy consultancy, and CEO of Global Business Network, a consultancy founded by some of the original pioneers of scenario planning. In that role, he led one of the world’s preeminent scenario practices as well as GBN’s global network of remarkable thinkers, helping leaders in industry, government, and philanthropy prepare for the future.

His scenario work has ranged widely across topics crucial to business, government, and nonprofit leaders, including the future of global commerce, the future of transportation and personal mobility, the impact of climate change on agriculture in sub-Saharan Africa, the future of the payments industry in Asia, and the implications of Brexit for US-based companies. He has advised CEOs and leadership teams in fields from consumer products, to automotive, telecommunications, media, financial services, health care/life science, industrials, energy, and philanthropy, and served clients on six of the world’s seven continents.

He’s the author “Truths and Consequences” on some of the drivers changing how business operates, “Deep Focus,” a study of the long-range forces shaping media and communications, and “Looking Out for the Future,” which explored how social problem solving could become more effective over the next generation, among many other publications.

He was the founding president of the board of directors of WITNESS, an international human rights organization created by the musician Peter Gabriel, and has served on numerous other boards and advisory groups.

Jeremy Bentham

Jeremy has been in the energy business for more than 30 years. He is a graduate of Oxford University where he read physics. He joined Shell in 1980 following post-graduate experience at the California Institute of Technology. He also holds a masters degree in management from the Massachusetts Institute of Technology, where he was a Sloan Fellow from 1990 to 1991.

Following experience in both research and technology process design, Jeremy worked in the areas of manufacturing economics, industry analysis and commercial information technology. He then held line management positions coordinating commercial and production activities at a number of refinery facilities. Subsequently he became manager of corporate strategy analysis within the Corporate Centre of the Shell Group, and then led a strategic project for Shell’s Exploration and Production Business.

Jeremy joined the leadership team of Shell’s global commercial technology company, Shell Global Solutions in 1999, with specific responsibility for commercial and strategic developments including new business. He was subsequently appointed as chief executive of Shell Hydrogen. Since January 2006 he has been responsible for Shell’s Global Business Environment team, which is best known for developing forward-looking scenarios to support strategic thinking and direction-setting.

Jeremy is married to an American artist, and they have three children ranging from 36 to 19 years old. He is deeply interested in theatre and passionate about encouraging young people through his church community.

Nick Butler

Nick Butler is a Financial Times commentator on the relationship between energy and power, plus the global trends and influences on the industry.

He is also visiting professor and chair of the Kings Policy Institute at Kings College London. He spent 29 years with BP, including five years as Group Vice President for Policy and Strategy Development at BP from 2002 to 2006. He has also served as Senior Policy Adviser at No 10, Chairman of the Centre for European Reform and Treasurer of the Fabian Society.

Zita Marko Daatland

Claudio Dicembrino

Claudio Dicembrino is currently the Enel Group chief economist. He joined Enel in 2011 where he first took responsibility for the macroeconomic scenario unit, he then served as head of macroeconomic and energy strategy. Before joining the firm, Claudio worked at the Italian Institute for Competitiveness (Rome, Italy), the United Nations Department of Economics (New York City), the Centre for Economics and International Studies at the University of Rome Tor Vergata (Rome, Italy), and the Italian Ministry of Economic Development. He received a BA in the economics of financial markets and international institutions, a MSc in development economics, and a PhD in economics from the University of Rome Tor Vergata. He has attended post-graduate courses in: econometrics at Queen Mary University of London (UK); public economics at I.S.E.O institute in Bergamo (Italy); and energy modeling at the International Energy Agency in Paris (France). His fields of interest include the functioning of international energy markets, commodity price volatility, and the interaction between economic growth and financial markets development. He has also been published in national and international scientific and peer reviewed journals.

Seb Henbest

Seb Henbest is Head of Europe, Middle East & Africa for Bloomberg New Energy Finance in London, overseeing the firm’s regional power, gas and carbon analysis and the development of its EMEA business. He is also lead author of BNEF’s annual long-term power market forecast, the New Energy Outlook.

From 2008 to 2012 Seb was Head of Research and Manager of BNEF in Australia, establishing the firm’s Sydney offices. Seb writes extensively on energy and carbon market economics for BNEF, as well as contributing to third party publication such as the London School of Economics Business Review and the Lowy Interpreter. He speaks regularly at energy industry conferences and events, is quoted widely in print media, and has appeared as an expert commentator on ABC TV, Sky News, ABC Radio, and Bloomberg TV.

In 2012 he gave evidence to the House of Representatives Economics Committee in Australia on the pricing dynamics of linking Australia’s Carbon Price Mechanism with the EU Emissions Trading Scheme.

He is a 2015 Rex J Lipman Fellow and has an advisory role with the GCC region Clean Energy Business Council. Seb is a physicist by training with degrees from Adelaide University and Monash. He also read International Relations at Cambridge University, specialising in emissions trading and environmental markets.

Dr. Martin Juckes

Martin joined the BADC in 2001 following a series of positions in Colorado (88-90), Reading (90-93), Munich (93-99) and Oxford (99-01) during which time he has published on stratospheric and tropospheric dynamics, baroclinic waves, the dynamics of the tropopause, data assimilation and paleo-climate temperature reconstructions. These positions have been a natural career progression for Martin following his degree and PhD (on stratospheric dynamics) obtained from Cambridge.

As head of atmospheric science for CEDA, Martin ensures that CEDA data services reflect and move with the needs of our designated user community. The immediate challenge is to deliver, in collaboration with European partners, the European component of the archive for the CMIP5 project; this archive will underpin much of the science that goes into the next assessment of the Intergovernmental Panel on Climate Change.

Carsten Jung

Carsten is the lead on climate risk analysis at the Bank of England’s International Directorate.

Matthew Jurecky

Matthew Jurecky has multiple years’ experience working internationally in energy research and consultancy for firms Wood Mackenzie and IHS. During this time, he engaged in a variety of projects, including offshore bid round strategy formulation for an independent, upstream acquisition screening for an international downstream company, and portfolio rationalization for a South American national oil company.

His areas of research centered on the upstream landscape of the Deepwater Gulf of Mexico and Onshore United States, assessing and forecasting regional supply, capital expenditures, and corporate strategies. His experience in the appraisal of unconventional assets led to his next role as an economist at Repsol, analyzing capital investment decisions. Here, he screened and formulated bid strategies for a variety of opportunities, including a service contract with a national oil company for mature fields, and a variety of exploration projects in the Onshore United States. During this time, he was instrumental in closing a US$1 billion joint venture with a large US independent, representing Repsol’s first investment in an unconventional resource.

Matthew has a Master of Business Administration from Texas A&M University and a Bachelor in Business Administration from Southern Methodist University.

Dr. Elmar Kriegler

Elmar is a senior scientist and vice chair of the Research Domain “Sustainable Solutions” at the Potsdam Institute for Climate Impact Research (PIK). His research focuses on the integrated assessment of climate change, scenario analysis and decision making under uncertainty. He is a member of the scientific steering committee of the Integrated Assessment Modeling Consortium (IAMC), has coordinated several international climate policy scenario projects and has been a core developer of the Shared-Socio-economic Pathways (SSPs) underlying the next generation of scenarios for climate change research. He has served as lead author of the IPCC Fifth Assessment Report and is currently serving as a lead author for the Chapter on 1.5°C Mitigation Pathways in the IPCC Special Report on 1.5°C Warming. Before returning to PIK, Elmar was a Marie Curie Fellow at the Department of Engineering and Public Policy at Carnegie Mellon University.

Leonardo Martinez-Diaz

Leonardo Martinez-Diaz is the Global Director, Sustainable Finance Center of the World Resources Institute. In this capacity, he leads our engagement with governments, development finance organizations, and private financial institutions to rapidly accelerate the shift to sustainable finance. He also guides and amplifies the Finance Center’s research, analysis and influence strategies, and oversees the technical support that the finance team provides across WRI.

Leonardo joins WRI after six years at the U.S. Department of the Treasury. As Deputy Assistant Secretary for Energy and Environment, he was responsible for overseeing multilateral climate and environmental funds, directing Treasury’s domestic and international work on climate finance, and leading on climate change elements of international negotiations, including at the G7, G20, UNFCCC COP, and the U.S.-China Strategic and Economic Dialogue. He stands out for his intimate knowledge of relevant institutions—he has worked for the IMF, World Bank and USAID, and served on the board of the Green Climate Fund—as well as his fresh ideas and force of intellect. He brings a wealth of international experience, including time in Indonesia and Mexico, and continues WRI’s tradition of close and trusting working relationships with all stakeholders, especially developing countries.

Emilie Mazzacurati

Ms. Mazzacurati is the Founder and CEO of Four Twenty Seven (427mt.com), an award-winning market intelligence firm specialized on the economic risk of climate change. Four Twenty Seven provides portfolio screening and equity scoring for the physical impacts of climate change, and helps financial institutions and Fortune 500 corporations integrate climate intelligence into strategic planning and investment decisions.

Previously, Ms. Mazzacurati was Head of Research at Thomson Reuters Point Carbon, where she directed research and modeling on carbon pricing. She also served as a policy advisor to the Mayor of Paris on environmental policy.

Ms. Mazzacurati was the lead author on the 2015 United Nations Caring for Climate report The Business Case for Responsible Corporate Adaptation and is a frequent speaker at international events on private sector climate risk and opportunities. She also served as a member of the state of California’s Technical Advisory Group for the implementation of Governor Brown’s Executive Order on climate change (EO B-30-15) and teaches at the University of California, Davis Executive MBA on Business & Climate Change.

Ms. Mazzacurati holds a Master’s of Political Science from the Institut d’Etudes Politiques de Paris and a Master’s of Public Policy from the Goldman School of Public Policy at University of California (UC), Berkeley, and is a Certified Global Reporting Initiative Reporter. She was a finalist for the Cartier Women’s Global Initiative in 2014 for women entrepreneur, et received the Visionary Award from the City of Berkeley, CA in 2016.

Dr. David McCollum

David McCollum is a Senior Research Scholar with IIASA’s Energy Program. His main fields of scientific interest include techno-economic analysis of advanced energy and transport technologies and the development and application of energy-economic and integrated assessment models. His research attempts to inform national, regional, and global energy and environmental policies on matters related to climate change, sustainable transport, energy security, and air pollution. To this end, Dr. McCollum performs long-term scenario analyses, particularly focusing on potential transitions for the energy system over the coming decades and the complex synergies and trade-offs between multiple energy objectives.

Dr. Christophe McGlade

Christophe is an oil and gas analyst in the Directorate of Sustainability, Technology and Outlooks of the International Energy Agency (IEA). Christophe joined the IEA in 2015 and leads the oil and gas modelling and analysis within the World Energy Outlook series—the Agency’s authoritative analysis of long-term global energy trends and challenges. Prior to joining the IEA, Christophe completed a PhD in energy and resources at the University College London (UCL) Energy Institute in 2013; he holds a BA and MSci from Queens’ College at the University of Cambridge in Theoretical and Experimental Physics and is an Honorary Senior Research Fellow at UCL.

Meryam Omi

Meryam is responsible for developing sustainability engagement programmes, integrating environmental, social and governance (ESG) aspects into the investment process and creating responsible investment product solutions.

Meryam has over 12 years of investment experience in asset management companies, starting her career as a business proposal writer for fixed income funds. She joined LGIM in 2008 to set up a business proposal team and project managed various business initiatives across a wide range of products and capabilities. After completing an MSc in Environmental Decision Making, she joined the Corporate Governance team in 2010 to establish the engagement programme on environmental and social topics as LGIM signed up to the UN Principles of Responsible Investment and the UK Stewardship Code.

Since then, she has led several projects to embed sustainability and corporate governance aspects into the investment offerings. She has carried out sector/theme specific engagements on key sustainability topics, such as green finance, water and corporate tax policy. She has more recently led the launch of Future World Fund and Climate Impact Pledge, which is a commitment to engage and act on climate change on behalf of all the clients’ assets LGIM represents.

She is on the board of Institutional Investor Group on Climate Change and an advisory board of Finance Dialogue on Climate Change.

Laurel Peacock

Dr. Silvia Pepino

Dr Silvia Pepino is senior manager of the Bank’s International Forecast team. Before, she led the policy and engagement effort of the Bank’s capital markets division. She is author of the book ‘Sovereign Risk and Financial Crisis’ (Palgrave Macmillan, 2015).

Prior to joining the Bank, she worked for fifteen years in leading global financial institutions, including as Chief Economist at Comac Capital, head of a Euro area economics team at JPMorgan, and senior economist at Brevan Howard Asset Management.

She holds a PhD from the London School of Economics and Political Science, the TRIUM MBA degree from New York University-Stern, HEC Paris and the LSE, and an MSc from Bocconi University in Milan.

Curtis Ravenel

Jillian Reid

Jillian is a Principal in Mercer’s Responsible Investment team, based in London. She is responsible for advising institutional investors, including pension funds, endowments, and Mercer’s Delegated Solutions, on integrating environmental, social, and corporate governance (ESG) factors, sustainability trends, climate change, and stewardship, throughout the investment process. Jillian was project manager and co-author for Mercer’s 2015 climate change study and report, Investing in a Time of Climate Change.

Jillian began at Mercer, in Sydney, in January 2004, holding various client facing roles across the investments business before transitioning to Responsible Investment in late 2011 and then to London in late 2014. Prior to Mercer, Jillian spent five years at an Australian multi-manager, after beginning her career in teaching.

Jillian holds a Master of Arts in Development Studies (University of New South Wales); a Bachelor of Arts and Diploma of Education (University of Newcastle); and a Graduate Diploma in Applied Finance & Investment (Financial Services Institute of Australasia).

Dr. Keywan Riahi

Keywan Riahi is Program Director, Energy Program, IIASA and Visiting Professor of energy systems analysis, Graz University of Technology, Austria.

Professor Riahi is currently Project Coordinator and member of Coordination Board of EU project on ‘Linking Climate and Development Policies-Leveraging International Networks and Knowledge Sharing (CD-LINKS)’. He is also member of Scientific Steering Committee of Integrated Assessment Modeling Consortium and other international and European scenario activities. His work within international modeling comparison projects, such as Stanford-based Energy Modeling Forum, focuses on spatial and temporal characteristics of technology diffusion and path-dependent development of energy system under alternative policy configurations.

Since 1998, he served as Lead Author and Review Editor to various international assessments, such as Global Energy Assessment (GEA), and reports of the Intergovernmental Panel on Climate Change (IPCC).

Professor Riahi’s main research interests are long-term patterns of technological change and economic development, particularly evolution of the energy system. His present research focuses on energy-related sources of global change, and on future development and response strategies for mitigating adverse environmental impacts.

Dr. Nicole Röttmer

Dr. Nicole Röttmer is the founder and CEO of The CO-Firm, The Carbon Opportunity Firm. She has been driving the development of financial climate transition risk models for several years, among others with Allianz Climate Solutions, Allianz Global Investors, WWF Germany, the Investment Leaders Group hosted by the University of Cambridge. Building on the ClimateXcellence toolset, she supports financial service providers, industry, public sector, and NGO clients in assessing climate risks and opportunities, and putting into numbers their impact on the national, international, sector-, and company-level.

As the Co-CEO of Lumics GmbH und Co. KG, a joint venture of Lufthansa Technik and McKinsey & Company, she was responsible for implementing change management programmes for several industries. Prior to that, she supported McKinsey & Company for nearly eight years, where she co-built the energy efficiency service line on energy improvements across production processes and supported the development of financial risk models.

Nicole provides expert support to the European Commission, UNEP FI, the German “Nationale Klimaschutzinitiative”, and among others is member of the board of 2° Investing Initiative in Germany.

She holds a PhD in strategic innovation management (merit price, European Committee of the Regions), and a diploma in economics.

David Rule

David Rule is Executive Director, Insurance Supervision at the Bank of England. Previously, David was Executive Director, Prudential Policy and previous to this Director, International UK Banks Supervision at the Financial Services Authority then Prudential Regulation Authority. David joined the FSA in August 2009 as Head of the Macro Prudential Department. Before that, he was Chief Executive of the International Securities Lending Association, a trade body representing participants in the European securities financing market. From 1990 to 2006 David worked at the Bank of England in a number of roles, including market infrastructure, financial stability analysis and banking supervision. From 2002 to 2006 he was Head of Sterling Markets Division at the Bank.

David is a member of the EIOPA Board of Supervisors and also continues to represent the Bank on the FSB Workstream on Securities and Lending Repos.

David has a degree in Modern History from Balliol College Oxford and further degrees in Political Science from the University of Toronto and Economics from Queens’ College Cambridge.

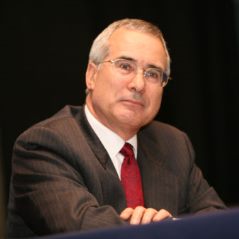

Mary Schapiro

Ms. Schapiro’s service as the 29th SEC chairman culminated decades of regulatory leadership. She was the first woman to serve as SEC chairman, and the only person to have served as chairman of both the SEC and the Commodity Futures Trading Commission.

During four years as chairman, Ms. Schapiro presided over one of the busiest rule-making agendas in the SEC’s history, during which the agency also executed a comprehensive restructuring program to improve protections for investors. Upon her departure, President Obama praised her leadership, saying the SEC became stronger and the financial system “safer and better able to serve the American people — thanks in large part to Mary’s hard work.”

Before becoming SEC chairman, Ms. Schapiro served as CEO of the Financial Industry Regulatory Authority, the largest nongovernmental regulator of securities firms. Earlier, she was chairman of the Commodity Futures Trading Commission; a commissioner of the SEC; and general counsel and senior vice president of the Futures Industry Association. She began her career at the CFTC, serving first as a trial attorney and later as counsel and executive assistant to the chairman.

Ms. Schapiro serves on the boards of Promontory Interfinancial Network, General Electric Co., and London Stock Exchange Group. She is also a member of the governing board of the Center for Audit Quality.

Dr. Misa Tanaka

Misa currently works as a senior research manager in the Research Hub. She has been working at the Bank since 2002, after completing a D.Phil in Economics at Nuffield College, University of Oxford. Misa’s current research interests are primarily in the areas of financial stability, macroprudential policy and microprudential policy.

Jakob Thomä

Jakob Thomae is Director of 2° Investing Initiative Germany. He helped co-found the 2° Investing network in New York and Berlin and manages the think tank’s research on 2°C scenario analysis for financial institutions and companies. Jakob led the development of the first 2°C scenario analysis tool for financial portfolios, now applied by over 200 financial institutions worldwide. Jakob also leads the organization’s partnerships with financial supervisors and governments in Europe, including in Switzerland and the Netherlands.

Javier Torres

Javier Torres is Project Manager for Sustainable Development and Climate Change (including adaptation) at EDF. His role includes trends analysis & strategy development. Javier is involved in analyzing environmental and social risks associated with the company’s investments. He also participates in the Group’s sustainable development communication and reporting activities.

Javier previously held roles as Investment Manager at former CDC Climat Asset Management (Groupe Caisse de depot, Proparco) in Paris, Carbon Originator at Abengoa in Beijing (China) and Trade Officer at the Commercial Office of the Spanish Embassy in Beijing.

Deepa Venkateswaran

Deepa Venkateswaran is the Senior Analyst at Bernstein covering European Utilities. Prior to joining Bernstein in 2013, Deepa was a Junior Partner in the London office of McKinsey & Company serving clients in the European power and utilities sector, and a member of the leadership team in McKinsey’s Utilities & Regulatory practices. She has deep knowledge of the entire power and gas value chain built up during the course of serving leading players for over seven years on topics of strategy & growth, corporate finance, and regulation. In the last few years at McKinsey, she focused significantly on regulation of power markets across Europe, supporting players and think tanks on the optimal regulatory posture and reform required in the face of the evolving dynamics in the European power sector. Deepa has an MBA with Distinction and a concentration in Finance from London Business School. She also qualified as a Chartered Accountant with Arthur Andersen. In 2017, Deepa was named to Institutional Investor’s All Europe Research Team as the No 3 ranked analyst in the utilities sector.

Michele Della Vigna

Michele is the Commodity Equity business unit leader in EMEA, coordinating strategy and content across the Global Equity Energy and Natural Resources teams in Global Investment Research (GIR). He is a member of the GlR Client and Business Standards Committee and European Investment Review Committee. Previously, Michele was co-head of European Equity Research from 2014 to 2017, and was co-manager of the Commodities and Energy business unit in European Equity Research from 2009 to 2014. He joined Goldman Sachs in 2001 as a financial analyst in European Energy Equity Research and was named managing director in 2009. Michele earned a bachelor’s degree in economics from Bocconi University in 2001.

Dr. Marcus Wachtmeister

Marcus Wachtmeister is Head of Government Affairs for BMW Group UK, with responsibility for the Group’s relationships with HM government and external stakeholders across the UK and Ireland. Prior to joining BMW in October 2014, Marcus spent over five years in Beijing for his doctoral research and working for GIZ, a German Government political consultancy in the area of electric vehicles, climate protection, and charging infrastructure. Marcus holds a DPhil in Environmental & Transport Policy from the University of Oxford, a Master of Chinese Studies with Distinction from the universities of Edinburgh and Glasgow and a Bachelor’s Degree in Integrated Social Sciences from Jacobs University Bremen.

Dr. Christopher Weber

In his role as Global Climate & Energy Lead Scientist, Dr. Weber works with WWF’s Climate and Energy Practice, as well as experts and partners around the world, to provide mission-relevant scientific and technical input on climate change and energy systems. Chris came to WWF from 2° Investing Initiative, where he led analysis and methodology development on climate-related risk and opportunities in investment portfolios. Prior to 2° Investing Initiative, he served as Senior Research Associate at the World Resources Institute, as a consultant to the UNEP Finance Initiative, and consulted on corporate sustainability for several Fortune 500 companies for Enviance, Inc. Earlier in his career Dr. Weber served as research professor at Carnegie Mellon University and as research staff member at the Science and Technology Policy Institute in Washington, DC, where he advised the White House Office of Science and Technology Policy on climate, energy, environmental and innovation policy issues. Chris holds an M.S. in civil & environmental engineering and a Ph.D. in civil & environmental engineering and engineering and public policy from Carnegie Mellon University.

Fiona Wild

Fiona joined BHP Billiton in 2010 as Senior Manager, Environment and was successfully appointed to the role of Vice President, Climate Change and Sustainability in February 2013. In this role, she is accountable for developing and maintaining the framework that enables BHP Billiton to deliver excellence in environmental performance. She advises the Board and senior management on emerging environmental and climate change trends and represents BHP Billiton in engagements with both national and international stakeholders, including NGOs, academics, industry associations, governments and investors.

She leads the implementation of BHP Billiton’s climate change strategy, including activities in the areas of mitigation, adaptation, portfolio evaluation, stakeholder engagement and low emissions technology. For example, in 2015, she led the development of BHP Billiton’s Climate Change Portfolio Analysis report. This industry-leading analysis describes the impact of both an orderly and a rapid transition to a low carbon future on the valuation of the company’s portfolio.

Fiona also holds several Board positions, including as a Director of IETA, which aims to build international policy and market frameworks for reducing greenhouse gases at lowest cost, and CO2CRC, one of the world’s leading collaborative research organisations focused on CCS.

Dr. Sonia Yeh

Dr. Sonia Yeh is Professor in Transport and Energy Systems in the Department of Space, Earth and Environment, Chalmers University of Technology. Sonia Yeh’s expertise is in energy economics and energy system modeling, alternative transportation fuels, sustainability standards, technological change, and consumer behavior and urban mobility.

Between 2007 and 2014, she co-led a large collaborative team from the University of California Davis and UC Berkeley advising the U.S. states of California and Oregon, and British Columbia, Canada to design and implement a market-based carbon policy (Low Carbon Fuel Standard (LCFS) and Clean Fuel Standard (CFS)) targeting GHG emission reductions from the transport sector.

She received Academic Federation Award for Excellence in Research by the UC Davis in 2014 and was appointed as Adlerbertska visiting professor at Chalmers University of Technology in 2015. She served as Fulbright Distinguished Chair Professor in Alternative Energy Technology in 2016-2017.

When & Where

Tuesday, October 31, 2017 – Wednesday, November 1, 2017

9 AM — 5 PM

The Ned Hotel

27 Poultry

London EC2R 8AJ

United Kingdom